KEY POINTS

- Novo Nordisk stock rallied after the FDA pledged action against unapproved copycat drugs.

- The rebound followed sharp losses tied to cheap compounded weight-loss drug competition.

- FDA warned it cannot ensure safety of unapproved drugs marketed as alternatives.

Shares of Danish drugmaker Novo Nordisk rose early Friday after recent heavy losses on investors’ concerns.

The rebound came after the U.S. Food and Drug Administration announced intentions to target marketing of unapproved copycat drugs.

The FDA’s commitment boosted market confidence, lifting Novo’s share price by about 4.7% in early trading.

The agency emphasised that it cannot verify the safety or effectiveness of illegal and unapproved drugs.

The earlier slump in Novo’s stock stemmed from news of aggressive pricing competition in the weight-loss drug market.

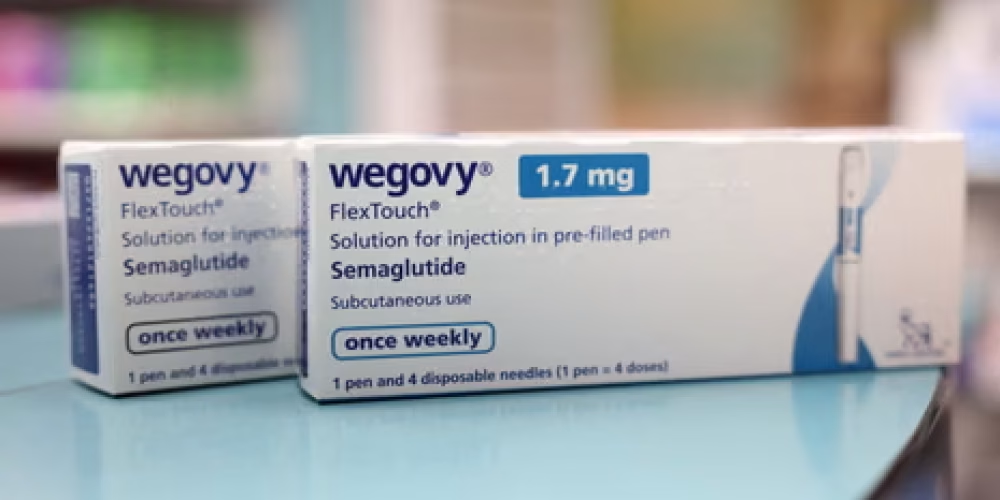

A lower-priced compounded version of Novo’s popular Wegovy weight-loss pill led to investor concern and share sell-offs.

On Wednesday, Novo warned of intensified price pressure and cut its full-year forecast, contributing to a steep drop in share value.

That drop brought the stock near its lowest level since Wegovy’s launch in mid-2021.

The FDA’s recent warning, posted publicly on social media, said it would take swift action against companies mass-marketing products that mimic approved drugs.

Officials did not name specific companies but stressed the agency’s role in safeguarding public health and drug quality.

Industry observers say unapproved compounded pills have complicated the competitive landscape for approved weight-loss therapies.

Some compounded variants marketed online do not undergo clinical trials or full regulatory review.

Novo has itself criticised some compounded products as lacking proven safety and effectiveness compared with its FDA-approved formulations.

The FDA’s stance may limit unregulated products that could undercut established treatments and patient outcomes.

The weight-loss drug market has grown rapidly in recent years, with semaglutide-based therapies driving demand.

Novo’s Wegovy pills and rival offerings are central to this fast-expanding segment.

Market analysts have noted that pricing pressure and competition could affect long-term profits for major drugmakers.

Novo’s earlier guidance cited intense price competition and expected declines in sales growth.

The FDA’s crackdown announcement offered investors reassurance amidst volatility.

How strictly the agency enforces its warnings will shape future market dynamics in obesity and weight-loss drug sectors.

Investors will likely watch both regulatory actions and competitive responses closely in coming weeks.

Novo’s stock reaction reflects both concern over competition and optimism about official enforcement.