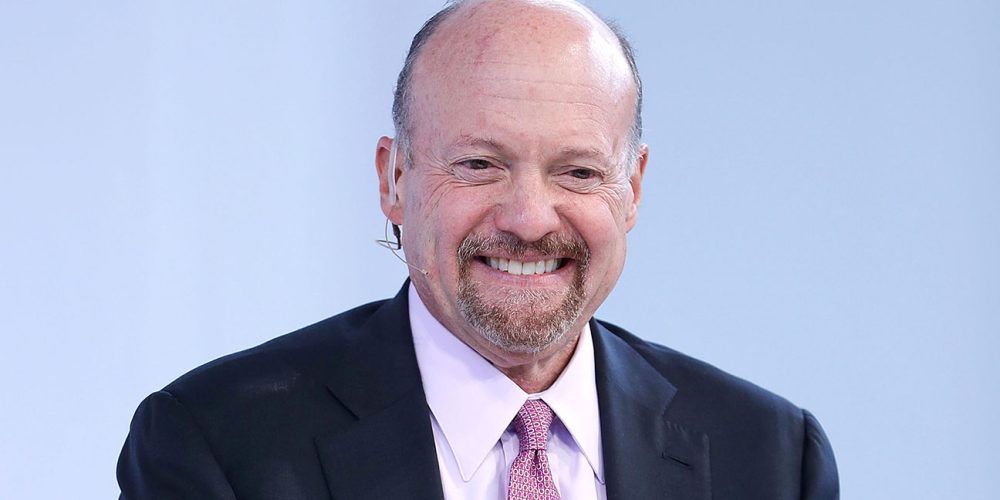

Veteran investor and TV personality Jim Cramer has issued a strong warning to those placing heavy bets on artificial intelligence stocks. In a recent commentary, he cautioned investors against piling too much into a single AI play, suggesting a more diversified approach given growing volatility and uncertainty in the sector.

Cramer’s shift in tone comes after a prolonged run of rallies in AI-related stocks, which have seen big gains amid investor zeal. He noted that while AI remains a transformative force, the current valuation levels for many companies no longer reflect fundamental business realities such as earnings or cash flow. According to him, the enthusiasm may be outpacing what the companies can realistically deliver.

Instead of concentrating investments in a handful of high-profile AI firms, Cramer recommends spreading exposure across a mix of companies. This includes established technology firms with diversified product lines, smaller firms involved in AI infrastructure, and traditional businesses poised to benefit from AI adoption. He argues this strategy can reduce the risk of significant losses if a particular AI stock falters due to overvaluation, regulatory pressure, or failed product launches.

Cramer also pointed out that AI hype tends to drive sharp upside but can equally trigger steep sell-offs when sentiment changes. Market conditions such as rising interest rates, shifting economic indicators, or disappointing earnings reports could spark rapid reversals, especially for companies without stable revenue streams. Investors heavily loaded into speculative AI names may find themselves exposed.

He emphasized that investors should pay close attention to balance sheets, recurring revenue, and long-term profitability rather than speculative forecasts. Discipline, Cramer argues, remains investors’ best defense in a market where technology trends and sentiment shift rapidly.

Cramer’s commentary reflects a broader shift among some market watchers who question whether the AI boom may be entering a correction phase. After years of runaway growth, and with many firms still operating at a loss while investing heavily in research and expansion, doubts about sustainable profitability are gaining traction.

More News. : OpenAI pivots toward enterprise growth with bold new partnerships

In response, some investors are already adjusting their portfolios. They are moving part of their AI holdings into value-oriented or dividend-paying stocks and increasing cash reserves as a buffer against potential volatility. Others are shifting toward AI-adjacent businesses with clearer paths to profit, such as chipmakers, cloud infrastructure providers, or firms offering AI-powered enterprise services.

Still, Cramer stressed that he is not “anti-AI.” Rather, his message is cautionary — an appeal for balance. He acknowledged that AI could reshape industries over the next decade, but urged that investors keep their feet on the ground and guard against excessive risk.

For many retail investors who may have entered the AI rally late, Cramer’s advice serves as a timely reminder: in a market driven by hype as much as innovation, measured decisions and diversification often pay off more sustainably than chasing the next big breakout.