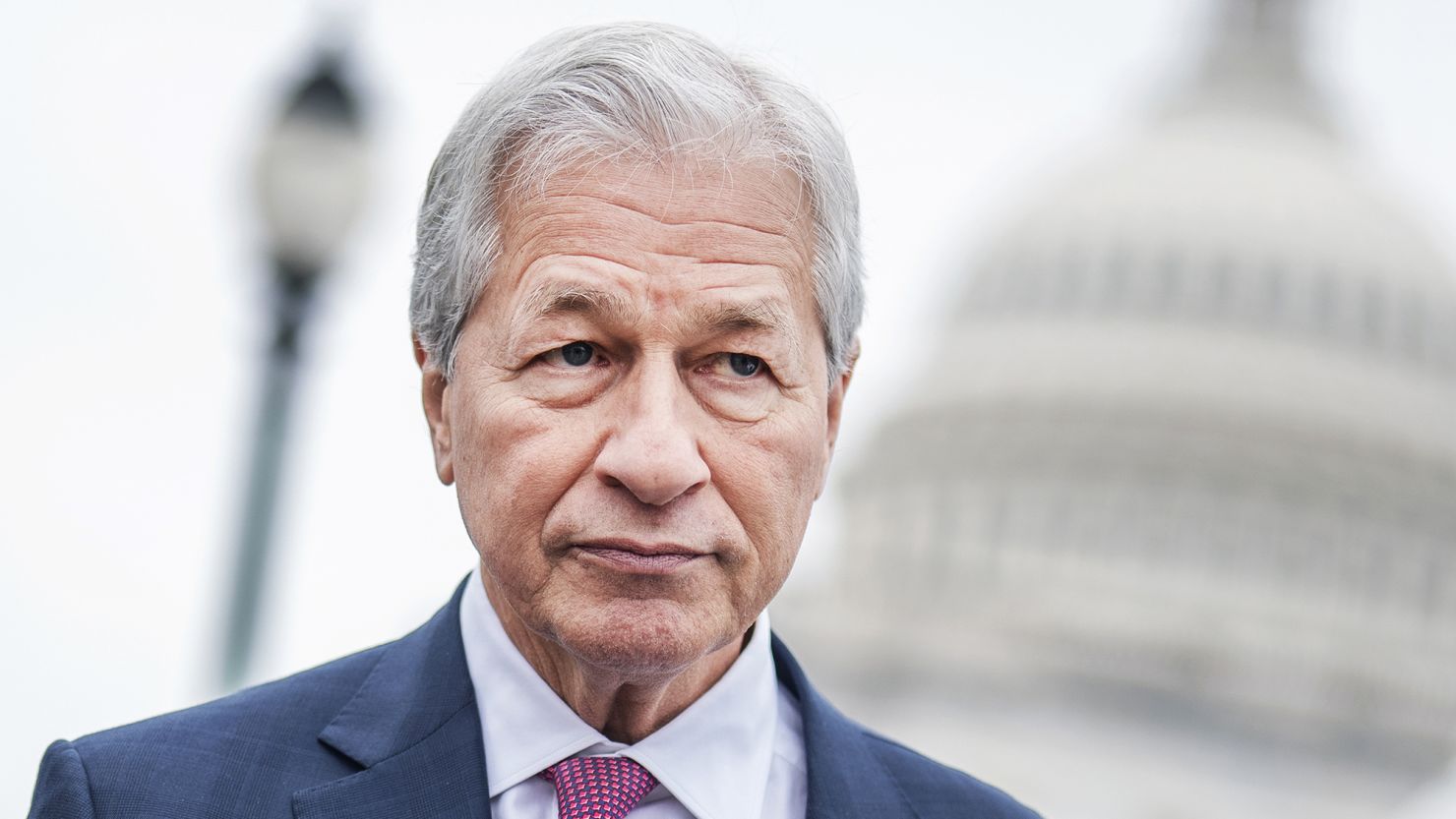

Jamie Dimon Warns of Possible Stock Market Correction Amid AI-Fueled Rally

New York — Global markets have surged to record highs this year, largely powered by enthusiasm over artificial intelligence. But JPMorgan Chase CEO Jamie Dimon is cautioning that the momentum may not last forever — and that a market correction could be looming.

In an interview with the BBC, Dimon said while he believes “AI is real”, much of the current investment frenzy may not yield lasting returns.

“AI will pay off in total — just like cars and TVs did — but most people involved in them didn’t do well,” he said.

Dimon warned there’s a higher probability of a meaningful market drop within the next six months to two years than what current sentiment reflects. “I’m far more worried about that than others,” he said, citing geopolitical tensions and rising government debt as major risks.

AI Hype Meets Bubble Concerns

AI has been the dominant market theme since OpenAI launched ChatGPT in 2022, sparking massive inflows into tech stocks. Companies like Nvidia, Microsoft, and Meta have poured hundreds of billions into AI data centers and infrastructure.

But some analysts fear this optimism mirrors the dot-com bubble of the late 1990s.

IMF Managing Director Kristalina Georgieva recently warned that valuations are approaching internet-era levels, saying a sharp correction could “drag down world growth.”

Signs of “Bubble Light” Territory

Despite record-breaking profits from Big Tech, strategists at Goldman Sachs and Boston Partners are urging caution.

Goldman noted that “circular financing” among AI giants and high market concentration are reminiscent of past bubbles.

Meanwhile, Mike Mullaney of Boston Partners described current conditions as “bubble light territory” — suggesting exuberance hasn’t peaked yet, but the warning signs are there.

A Market Dominated by Big Tech

Just seven companies — Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla — have contributed 55% of the S&P 500’s gains since late 2022, according to S&P Dow Jones Indices. That concentration leaves investors heavily exposed if AI expectations falter.

Both the Bank of England and Federal Reserve Chair Jerome Powell have expressed concern that valuations, particularly in AI-driven sectors, look “stretched.”

Still, some analysts argue this boom differs from the 1990s. “Unlike the dot-com era, today’s mega-cap tech firms are highly profitable,” said Eric Freedman of U.S. Bank Asset Management. Others, like Ed Yardeni, say a correction may not hit until 2026 — if ever.

For now, Dimon’s warning stands as a reminder that even genuine technological revolutions can carry speculative excess — and history has shown what happens when optimism outruns reality.