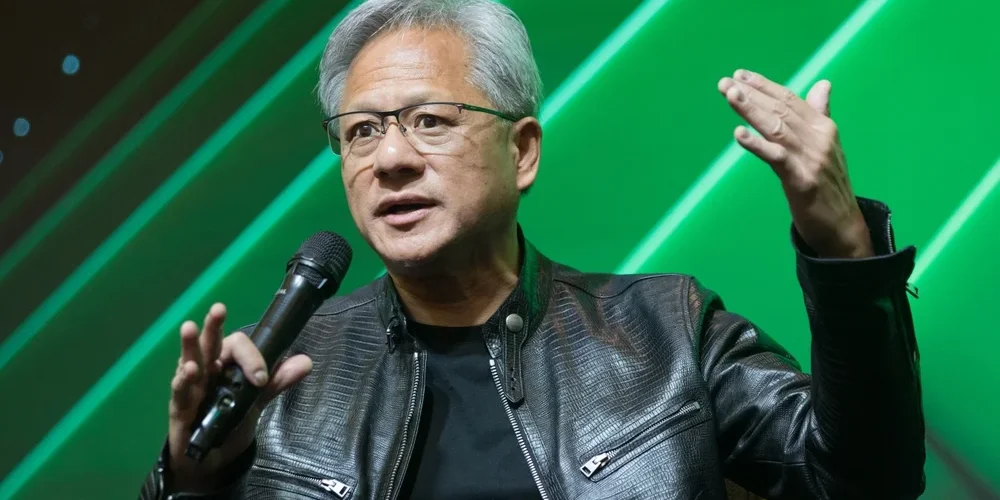

Nvidia CEO Jensen Huang believes the world is moving through a defining moment for artificial intelligence, arguing that the rapid rise of AI technology represents a long-term transformation rather than a short-lived investment bubble. His comments come as Nvidia continues to dominate the AI chip market, even as some analysts caution that soaring valuations may not reflect the sector’s real financial risks.

During a recent discussion, Huang described AI as the next major computing shift, comparable to past breakthroughs like the internet and smartphones. He stressed that organizations across nearly every industry are adopting AI tools to streamline processes, create new products, and reshape business operations. According to him, this wave of adoption is still in its early stages and will accelerate as companies gain access to more advanced models and infrastructure.

Nvidia’s market position remains unmatched, with its chips powering most of today’s leading AI systems. Demand has surged so quickly that supply remains tight, driving record revenues and making Nvidia one of the most valuable companies in the world. Huang argues that this demand is evidence of structural change, not speculation, and that the global economy is entering an era where AI becomes essential for competitiveness.

However, not everyone shares this optimism. Several economists and market watchers warn that the pace of investment in AI could be unsustainable. They note that companies may be spending heavily on AI infrastructure without clear pathways to profitability. Skeptics also draw parallels to past periods of tech hype, including the dot-com boom, when enthusiasm outpaced real-world adoption.

Despite these warnings, supporters believe AI offers tangible benefits that justify aggressive investment. From healthcare and logistics to finance and manufacturing, many sectors are already integrating advanced models to improve accuracy, cut costs, and accelerate innovation. Companies that delay adoption risk falling behind competitors who are becoming more efficient with AI-driven workflows.

Huang acknowledges the concerns but insists that AI is solving real problems and generating measurable value. He highlighted that enterprises are not just experimenting—they are deploying AI at scale to enhance security, automate tasks, and drive new revenue streams. He added that as models grow more capable, even small businesses will be able to use AI tools that were once limited to large tech companies.

Investors continue to watch the sector closely, tracking how fast AI projects translate into earnings. While Nvidia remains central to the industry’s growth, the company also faces intensifying competition from rivals developing their own high-performance chips. At the same time, governments are examining AI regulation, which could slow deployment if stricter rules are enforced.

Still, the momentum behind AI shows no signs of slowing. Cloud providers, startups, and established corporations are racing to secure the computing power needed to train and deploy large models. Huang believes this demand will continue expanding as AI becomes deeply embedded into business operations and daily life.

The debate over whether AI represents a bubble or a genuine technological revolution continues to shape market sentiment. But for Nvidia’s CEO, the answer is clear: AI is transforming the global economy, and the world is only at the starting point of what he calls a decades-long shift.

Read More News : NVIDIA Becomes First $5 Trillion Company as AI Boom Peaks